Never Ending Learning =D

Saturday, 7 May 2011

Quiz for Basic Accounting

The quiz consist of 10 questions. You have 30 minutes to complete the quiz. The minimum grade for the quiz is 70%. Please register with your real name as the completion of this quiz is a requirement for the assignment.Accounting quiz The quiz should be completed when you have review the notes presented in this blog.

Sunday, 1 May 2011

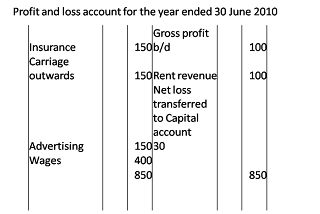

profit and loss account (format) (Net loss)

This is the format for net loss in profit and loss Account.

Feel free to ask me if there is any questions

profit and loss account

On the debit side(left side) of the profit and loss account the items recored are:

- any expenses

- Discount allowed

On the credit side(right side) of profit and loss account the items recorded are:

(a) Discount received

(b) Commission received

(c) Rent received

(d) Interest received

(e) Income from investments

(f) Profit on sale of assets

(g) Bad debts recovered

(h) Dividend received

(i) Apprenticeship premium etc.

When you have add everything , you have to add up the amounts and u can find out if it is a net profit or net loss . Net profit is the left is the amount is has lesser money then the right side and net loss is the opposite. :D

Just to sum up if it is an expenses record it one the left side and income/revenue on the right side

and if the income is more then the expenses it is a net profit if it is lesser it is a net loss :D

When you have add everything , you have to add up the amounts and u can find out if it is a net profit or net loss . Net profit is the left is the amount is has lesser money then the right side and net loss is the opposite. :D

Just to sum up if it is an expenses record it one the left side and income/revenue on the right side

and if the income is more then the expenses it is a net profit if it is lesser it is a net loss :D

Saturday, 30 April 2011

Accounting terms

Accounting Equation

Assets - Liabilities =Capital Fixed Assets + Current Assets -Current Liabilities - Long term Liabilities = Capital + profit - drawings Accounting ratios

Used to help make sense of the figures and include the following categories: Accrual

An amount unaccounted for, yet still owed at the year end. The amount needs to be estimated and then added to the expenses deducted from the profit in the Profit and Loss account. The same amount also needs to be added to Trade Creditors in the Current Liabilities section of the Balance sheet Learn more about this

Asset

An item of value owned by the business

Balance Sheet

A financial statement that shows what the business is worth. This is a very simple definition as the valuation of a business is a very complex topic. It shows the business assets and liabilities at one point in time and is sometimes referred to as the "snap shot".

Bank & Cash

Amounts held in the bank and in cash. Found in the Current Assets section of the Balance Sheet. If the amounts are in deficit, then the bank account is said to be an overdraft and will not appear in current assets but will be found in the Current Liabilities section of the balance sheet.

Capital

Items, usually cash or other assets introduced into the business by the owners. Sometimes referred to as Capital Introduced. For companies this is referred to as share capital and Capital Employed is the term given to the total of:

Cash

Money. Can be in the petty cash tin in the office or at the bank.

Current Asset

Assets which are expected to be used up and replaced within one year. Sometimes referred to as short term assets.They can be : Current Liability

Amounts owed (within one year) for goods and services purchased on credit terms. This means payment for goods and services is due at a date later than the date of sale. Current liabilities can be: Depreciation

Drawings

Assets withdrawn from the business by the owners. These assets are usually cash but can be any asset withdrawn. In company accounts the withdrawal of assets by the owners is either called : Fixed Assets

Assets used within the business and not acquired for the purposes of resale. Examples include:

Land and buildings

Plant and machinery, such as knitting machines and cup making machinery

Fixtures and fittings, such as light fittings and shelving

Motor vehicles, such as vans and cars.

Fixed assets must be shown at original cost(purchase price) or valuation. Valuation is preferred in the case of assets which have changed significantly in value since original purchase. For example the current value of land and buildings can be quite different from the original cost.

Accumulated Depreciation must also be shown, which is deducted from cost (or valuation) to give net book valueGoodwill

comes in two flavours: Legal framework

The law controls what kinds of books, records and systems of internal controls that must be maintained by companies which are subject to an annual examination by external auditors. You will learn much more about these in your studies.

Long term Liability

Amounts owed to someone else which are payable after one year. Examples include:

Net current assets

Sometimes referred to as working capital, this is the difference between total current assets and total current liabilities and is what finances the business on a day to basis.

Net Assets

Is the difference between the total assets and total liabilities.

Profit

There are many types of profit: Reserves

amounts retained in the business and not distributed to owners. Reserves can be:

Shares

Amounts invested in a company by its owners. Owners of companies are called shareholders

advertising

rent and rates

wages and salaries

travelling expenses

light and heat

Office Expenses

Miscellaneous Expenses

bank interest

loan interest

depreciation

Provision for doubtful debts . This represents an estimate of amounts customers have difficulty paying due to their cash flow problems. This figure will be deducted from the profit in the Profit and loss Account and will also be deducted from the Debtors figure in the Balance Sheet.

bad debts written off

Amounts owed by customers that cannot afford to pay because they have gone into liquidation. These amounts need to be deducted from the profit in the Profit and Loss Account and also from the Debtors figure which is found in the Current Assets section of the Balance Sheet.

accruals and prepayments.

Accruals are amounts unaccounted for yet still owing at the year end . Estimates need to be made and then added to the expenses deducted in the Profit and Lossaccount. This amount also needs to be added to Trade Creditors in the Current liabilities section of the Balance Sheet . Prepayments are amounts paid for by the business in advance of goods and services received. These amounts need to be deducted from expenses in the Profit and Loss account and will also appear in theCurrent Asset section of the Balance Sheet along with Debtors.

- Is a useful rule which helps when assembling the balance sheet figures. The rule which is always true is that:

- This means that when preparing a balance sheet there will always be two figures which are the same and we refer to this state as the the balance sheet balancing

- Profitability ratios , used to compare the profitability of one company with another or of one company over time.

- Liquidity ratios, used to compare the liquidity of one company with another or of one company over time.

- Investment ratios, used by potential investors when making investment decisions.

- Efficiency ratios, used to compare company efficiency with others or with itself from one year to another. Accounting ratios are only useful when used to compare:

- one company's results over a period of time.

- one company's results with another company. It is best to compare with the best ,such as a world class company, or to compare with the industry standard for that type of business.

- the company's results with those expected. It is useful to use budgets for this purpose.

- Share Capital (which comes in two varieties ordinary and preference)

- Loan capital (which is simply a grand name for long term loans)

- Reserves

- stocks of finished goods or raw materials or partially finished good known as work in progress. This amount is also referred to as closing stock and can be found in the Trading account section of the Profit and loss Account. It is important to remember that Closing stock appears both in the Balance sheet and in the Profit and Loss Account.

- amounts owed to the business from its customers and known as Debtors. Customers come in two varieties:

- Cash customers which pay for goods at the time of sale

- Credit customers which pay for goods at a later date. It is from these sales that debtors arises i.e. amounts owed from customers.

- amounts paid in advance (at the end of the accounting year) of goods and services received and referred to as Prepayments Prepayments are shown as added to debtors.

- cash and bank

- Trade creditors, which is the name we give to amounts owed to suppliers.

- Accruals, which is the name we give to amounts still owed at the year end and not yet recorded in the books of account.

- Proposed items such as Dividends proposed, which means amounts the business promises to pay in the coming year.

- Payable items such as Tax payable which is payable within the coming year.

- Overdraft, which is amounts owed to the bank.

- Short term loans

- Is the measure of wearing out of a fixed asset. All fixed assets are expected to wear out, become less efficient and to get "tired". Depreciation is calculated as the estimate of this measure of wearing out and is a charge in the Profit and loss Account. Accumulated Depreciation is the total depreciation charges to date deducted from the cost of the fixed assets to show Net Book Value in the Balance Sheet learn more about depreciation

Watch a car becoming more worn out over time When you have finished you need to press escape and return.

- salaries if it is payment for work done by the owner or

- dividendsif it is for a share of the profits

Accumulated Depreciation must also be shown, which is deducted from cost (or valuation) to give net book value

- Inherent goodwill, which is supposed to reflect the reputation and other positive characteristics of the business which are all difficult to put a value on. This type of goodwill should not appear on the Balance Sheet

- Purchased goodwill, which is the excess of purchase price over fair value of the net assets of the business acquired by the purchaser. learn more about goodwill

- Long term loans

- Debentures , which are long term loans secured on the business assets. This means if the business fails to repay back the loan on time the business assets are at risk.

- Cash surplus, which is the difference between receipts and payments.

- Taxable profit, which is the business profit adjusted for tax purposes.

- Accounting profit, which is the difference between:

- Income received or receivable and

- Expenditure paid or payable within an accounting period Often referred to as NET Profit

- Profits made and not passed on to owners. These are some times known as retained earnings.

- Capital reserves which can not be passed on to owners and represent the perceived increase in valuation of some fixed assets.

The profit and loss account words

- Accounting Period

- Is the period under examination and usually refers to a year. We therefore refer to a Profit and loss Account for the year ended so and so or a Balance Sheet as at so and so.

- Accruals or Matching concept

- Is the reason why net profit made is not the same as the cash surplus generated. This is a critical concept for you to understand. It is a fundamental concept upon which the accounts are prepared. You will learn in your studies that profit is not cash for a number of reasons:

- because of applying the accruals concept to preparation of accounts. This is where we deduct from sales the amounts we have incurred to achieve those sales - WHETHER WE HAVE PAID FOR THEM OR STILL OWE FOR THEM is irrelevant. In other words we count all costs incurred including those still owing to trade creditors at the end of the year. The costs deducted in the accounts will therefore be greater than the actual cash payments made where amounts are still owed at the end of the year. Similarly the sales figure is not made up of cash received from customers but is made up of cash received together with that still to be received.

- because of accounting for depreciation which is a deduction against profits for the measure of wearing out of a fixed asset and therefore does not involve a cash payment

- because of the way we value closing stock which can be by using average unit costs, the last unit costs or the earliest unit costs. None of these methods reflect the actual flow of cash because they are all estimates only. You will learn that this is where we consider FIFO (first in first out) and LIFO (last in first out) valuations of closing stock. learn more about the matching concept learn more about stock valuation

- Expenses

- Referred to as expenditure and including examples such as:

Amounts owed by customers that cannot afford to pay because they have gone into liquidation. These amounts need to be deducted from the profit in the Profit and Loss Account and also from the Debtors figure which is found in the Current Assets section of the Balance Sheet.

Accruals are amounts unaccounted for yet still owing at the year end . Estimates need to be made and then added to the expenses deducted in the Profit and Lossaccount. This amount also needs to be added to Trade Creditors in the Current liabilities section of the Balance Sheet . Prepayments are amounts paid for by the business in advance of goods and services received. These amounts need to be deducted from expenses in the Profit and Loss account and will also appear in theCurrent Asset section of the Balance Sheet along with Debtors.

- Gross Profit

- Is calculated by deducting Cost of Sales(sometimes referred to as Cost of goods sold) from sales. Cost Of Sales is calculated by taking:

- Opening stock, which is the value of stock which exists at the beginning of the accounting period

- Plus Purchases of goods for resale, made during the accounting period. One common mistake made by students is to confuse purchases with stocks. Purchases of stocks are dealt with through the purchases account and not through the Opening and closing stocks.

- Less Closing stock, which is the value of stock which exists at the end of the accounting period In other words, it is the value of goods purchased during the year and in stock at the beginning of the year, less those items sold during the year. This is the figure which also appears in the balance sheet as stocks and can be found in the current assets section. learn more about cost of sales

- Historic cost

- The method used for preparing accounts which estimates the actual purchase price of all items purchased. This is as opposed to the alternatives which could be to use instead the:

- cost of replacing items when they are sold or disposed of .Known as the Replacement cost or net realizable value

- income expected if items were sold. Known as the Realization cost

- Net Profit

- Sales less cost of sales less expenses = net profit.

- Sales less cost of sales = gross profit.

- Therefore Net Profit = gross profit less expenses.

- In other words Net Profit represents the surplus of sales made over expenditure during the accounting period. If a deficit is made(i.e if expenditure is greater than sales) then this results in a net loss and not a net profit.

- Profit and Loss Account

- Shows what net profit or loss the business has made within an accounting period after deducting all expenditure from the income. A net profit is earned if total expenditure is less than the sales figure. A net loss is made if it is greater. Comes underneath the Trading Account

- Sales

- Income received or receivable for the accounting period. Sometimes referred to as Turnover.It represents the sales value of goods and services made to customers during the year.

- Trading account

- Shows what Gross Profit the business has made within an accounting period It comes on top of the Profit and Loss Account

Format for trading account

| Trading account for the year | ended | 30 June | 2010 | |||||

| $ | $ | $ | $ | |||||

| Opening stock | 200 | Sales | 1500 | |||||

| Purchases | 1200 | Less: returns inwards | 30 | 1470 | ||||

| Less returns outwards | 400 | |||||||

| 800 | ||||||||

| Add: Carriage inwards | 50 | |||||||

| Add: Duty on purchases | 50 | |||||||

| Add: Freight on purchases | 50 | |||||||

| Add: Wages on purchases | 50 | 1050 | ||||||

| Cost of goods available for sale | 1250 | |||||||

| Less closing stock, 30 June 2010 | 400 | |||||||

| Cost of goods sold | 850 | |||||||

| Gross profit c/d | 620 | 1470 |

Trading Account

Trading account only must have

- stock

- purchases

- sales

- purchases returns

- sales returns

- carriage inwards

• Purchases Returns a/c

Purchase Returns a/c is a nominal account. It provides the information relating to the value of goods/stock returned to the seller from whom the stock has been purchased.

Being a nominal account, this account is closed at the end of the accounting period.

• Sales Returns a/c

Sales Returns a/c is a nominal account. It provides the information relating to the value of goods/stock returned by the buyers to whom the stock has been sold.

Being a nominal account, this account is closed at the end of the accounting period.

• Gross Purchases and Gross Sales

The Purchase Returns a/c and the Sales Returns a/c provide information relating to returns only.

Since returns are recorded separately using these accounts, the Purchases a/c and Sales a/c give the information relating to the Gross Purchases and Gross Sales.

• Need for information relating to Net Values

Along with the information relating to the returns and the gross values, the organisation needs the information relating to the net values i.e. the net purchases and net sales made by it.

Subscribe to:

Comments (Atom)